Human-Centered AI for Financial Services That Works With Your Systems Today

AI voice and chat conversations designed for your customers, compliant for your regulators, and compatible with your legacy systems.

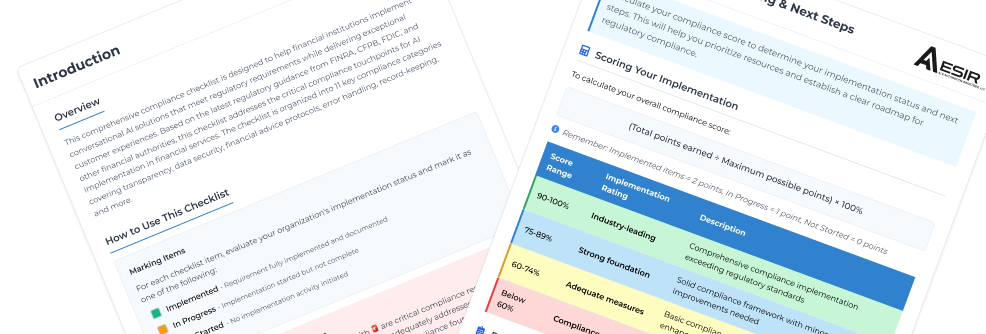

Get a comprehensive AI compliance checklist based on the latest FINRA, CFPB, and FDIC regulations to implement conversational AI that satisfies regulators while delighting your customers.

Legacy System Integration Design

Design AI experiences that work with your existing systems. I create implementation frameworks that help your technical team connect modern AI to legacy banking platforms in weeks, not months—without replacing your core.

Financial Conversation Design

Transform robotic banking interactions into natural, compliant customer experiences. My conversation design frameworks incorporate regulatory requirements from the start, helping you deploy AI up to 80% faster than traditional approaches.

Compliance-First AI Design

Design AI conversations that respect regulatory boundaries from day one. My compliance frameworks help you identify potential issues before regulators do, with guardrails that keep interactions within approved parameters while still delivering excellent customer experiences.

Regulatory-Ready Conversation Workshops

Workshops that equip your team with the skills to design compliant AI conversations. Learn how to create dialog patterns that satisfy regulators while delighting customers, turning compliance from a roadblock into a competitive advantage.

Knowledge Transfer That Creates Independence

I believe in creating self-sufficiency, not dependencies. Every engagement includes customized training, conversation design templates, and hands-on workshops that empower your team to maintain and improve your AI experiences long after our engagement ends.

AI Experience Design Workshops

I empower your team to create exceptional AI experiences through specialized training designed specifically for financial institutions:

- Customer journey mapping for AI interactions that reduce call escalations

- Compliance-ready conversation design workshops for your content teams

- Implementation guidance that helps your technical team integrate with existing systems

- User experience optimization that typically saves 30-40% on routine tasks

Unlike general AI training, these workshops address the specific challenges of financial institutions with legacy systems and strict regulatory requirements—all through the lens of user experience.

I transform how financial institutions connect with customers through AI experiences that feel human to your customers, satisfy your regulators, and work with your legacy systems.

With a 10+ year background in product and UX design, I bring a human-centered approach to financial AI that focuses on creating exceptional customer experiences while respecting the unique constraints of banking technology and regulations.

I specialize in helping mid-sized banks, credit unions, and insurtech companies implement AI conversations that integrate with existing systems, maintain compliance, and significantly improve customer satisfaction.

Is your banking AI frustrating customers and concerning regulators?

Let’s design a better experience in just 6 weeks.

Why Financial Institutions Choose Aesir

- Human-centered design that reduces call center escalations by 40-60%

2. Compliance frameworks built into the conversation design from day one

3. Implementation guidance that works with your existing systems, not against them

4. Financial UX specialist focused exclusively on banking and insurance experiences

5. 6-week implementation process compared to industry standard 18+ months